He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Regular evaluations are crucial, especially during significant market changes. However, the frequency of calculations depends on individual investment goals and market conditions. Common stock, influenced by market fluctuations, carries inherent risks, requiring careful analysis and strategic decision-making. Examine the importance of historical data in predicting stock trends. Learn how past performance can offer valuable insights into future common stock movements.

What is your risk tolerance?

For a company to issue stock, it initiates an initial public offering (IPO). An IPO is a major way for a company seeking additional capital to expand the enterprise. To begin the IPO process, a company works with an underwriting investment bank to determine the type and price of the stock. Once the IPO is complete, the stock becomes available for purchase by the general public on the secondary market.

Part 2: Your Current Nest Egg

Our partners cannot pay us to guarantee favorable reviews of their products or services. Ask a question about your financial situation providing as much detail as possible. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Great! The Financial Professional Will Get Back To You Soon.

A corporation’s accounting records are involved in stock transactions only when the corporation is the issuer, seller, or buyer of its own stock. The corporation will go about its routine business operations without even noticing that there were some changes among its stockholders. The common stockholder has an ownership interest in the corporation; it is not a creditor or lender. If stockholders want to sell their stock, they must find a buyer usually through the services of a stockbroker or an online app. Nowhere on the stock certificate is it indicated what the stock is worth (or what price was paid to acquire it).

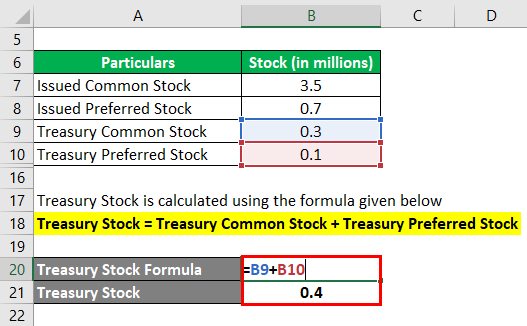

It shows that the company has more resources because of the investment from common shareholders. Stockholders’ equity is the remaining assets available to shareholders after all liabilities are paid. It is calculated either as a firm’s total assets less its total liabilities or alternatively leveraging process frameworks to simplify process as the sum of share capital and retained earnings less treasury shares. Stockholders’ equity might include common stock, paid-in capital, retained earnings, and treasury stock. The common stock on balance sheet are shares issued by an entity to the general public for investing in them.

- Like other securities, it is subject to market forces and price swings.

- It’s one of the common reasons some customers have started using our inventory management software, inFlow.

- Assets are resources that a company owns or controls that have the potential to generate future economic benefits.

- Some of them are relatively benign, while others involve outright crimes.

Now that you’re equipped with this foundation of knowledge, all you need to do to figure it out is to go look it up on any company’s balance sheet in their 10-Q or 10-K filing. Helpful Fool Company’s board has elected to issue just 2,000 shares at this time. Therefore, the company currently has authorized 5,000 shares and has 2,000 shares issued and outstanding. In wrapping up this journey through the intricacies of common stock calculation, remember that knowledge empowers confident decision-making.

Let’s explore more about common stock and how it fits into the big picture of a company’s finances. NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only.

It includes common stock, retained earnings, and other equity accounts. A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a given point in time. It shows what a company owns (assets), what it owes (liabilities), and what is left over for shareholders (equity). Throughout this captivating journey, we will unravel the steps involved in calculating common stock, uncovering the significance of stock issuances, par value, and additional paid-in capital. Together, we will dive into the intricate tapestry of corporate finance, empowering you to see beyond the numbers and grasp the true essence of a company’s financial foundation. The more shares of common stock you have, the bigger your part of the company.

Save more by mixing and matching the bookkeeping, tax, and consultation services you need. U.S. residents who open a new IBKR Pro account will receive a 0.25% rate reduction on margin loans. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website.

In this situation, it is necessary to give the service a specific value (Monetary value). As an illustration, the XYZ startup agrees to pay the $30,000 in attorney fees through the issuance of equity. The amount of equity to be issued is $3 per share ($2 is the value of the PAR, and $1 is above the PAR). Preferred stock is listed before common stock on the balance sheet because the preferred stock is preferred in terms of dividends, assets, or both. The company provides the conversion rate in a footnote or a parenthetical note following the description of preferred stock.

While a stock price can theoretically go to zero, the valuation doesn’t go negative. A negative valuation would imply that the company owes more than its assets are worth. Simplify the process with online calculators designed for common stock calculation. Explore user-friendly tools that streamline the math, allowing you to focus on the analysis.